I usually do my taxes as soon as I get my W2 in January. I only have one job, I don’t own a house, I’m not married, and I have no kids, so it’s fairly easy and I always get a refund. I just upload my W2 to hrblock.com, answer a few questions, and my refund usually gets direct deposited a few weeks later.

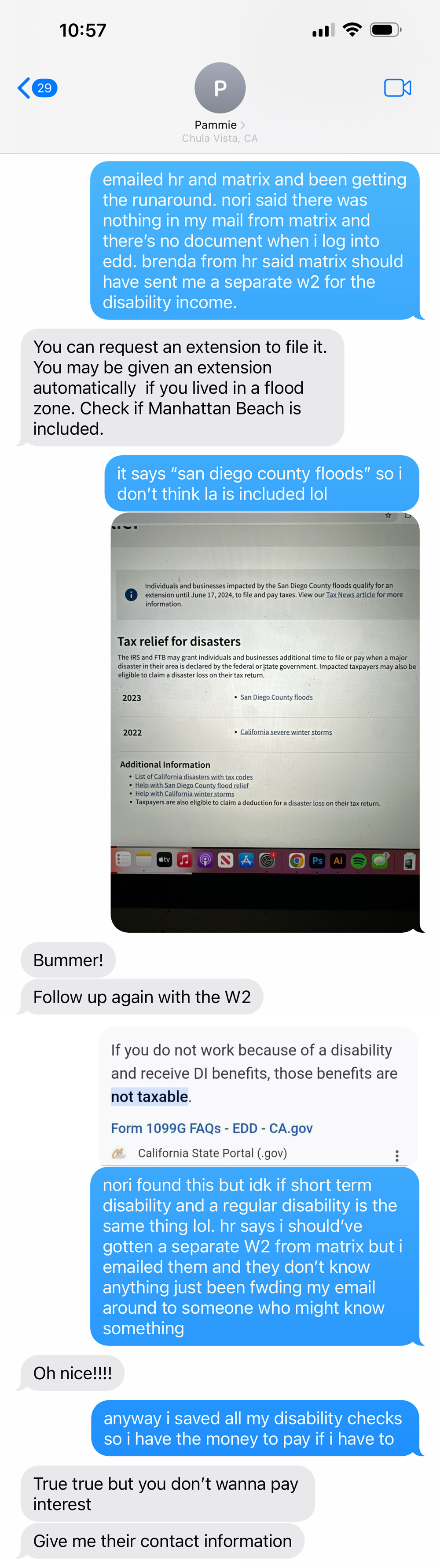

Since I had the stroke last year and received tax-free disability checks during my medical leave for six months, I waited till the eleventh hour to do my taxes, because I assumed I’d have to pay taxes on that income. It took months for my disability to get approved, so I used up all my sick time and vacation (which I was max’d out on) to get paid in the meantime. When my disability finally got approved, it was retro to when I applied in January, so I got a ton of money and it was all tax-free. I didn’t need the money, because I wasn’t spending $5,000 on doordash every month anymore LOL, so I opened a high-yield savings account and just let the money sit in there and gain interest ever since.

I never got a form with the disability income, and HR thinks I should’ve received a separate W2 for that income. I had my friend who goes into the office near my apartment check my mail, and I didn’t receive anything from the company they use. I also emailed my contact at the company, and she just forwarded my email to someone who could help.

I’m too young to know anyone else who has had a stroke or gotten short-term disability LOL, so if you know someone who has, please send them my way to give me some insight 🙏🏼

If I don’t have to pay taxes on those disability checks, I’m either gonna buy a Tesla with that money, or doordash some banana pudding ice cream from Coldstone, I haven’t decided yet…

Sidenote: You don’t want to mess with my boss ass bitch sister. I can hear her in her work meetings sometimes making her employees cry 😅